Quick and easy ways to save money now

I feel like part of my job and my duty to you as the sisterhood of savings is to give you tips on how to save money. Doing some of these things is how we got out of debt, how we stayed out of debt, how we've been able to cash flow things like cars and roofs and trips to Disney World.

I feel like part of my job and my duty to you as the sisterhood of savings is to give you tips on how to save money. Doing some of these things is how we got out of debt, how we stayed out of debt, how we've been able to cash flow things like cars and roofs and trips to Disney World.

1. Start meal planning.

Not only is this going to save you literally thousands of dollars because you're not throwing away food -- the average family in the US throws away $1,500 of food every year. Not with a meal plan -- but you also save time. Think about it.

If you come home on a Monday night and you're exhausted, you're going to spend at least 30 minutes wandering around your kitchen looking for something to eat. If you have taken 15 minutes on a Sunday afternoon to meal plan for the week, you just got hours of your life back. If you are spending 30 minutes every day or at least every week looking for something to eat, and you take 10-15 minutes to meal plan, you have saved hours every year.

2. Pack leftovers for lunch.

I have talked about this. You'll save at least $2,000 a year. Easy. A travel mug and take your own coffee. You can make coffee at home -- good coffee -- for 25 cents a cup. I love to use these pyrex containers for lunches.

3. Never run a movie without a Redbox code.

Even if it's not a completely free movie, get a Redbox code. I realized that Redbox is only like $1.50. I get it. And even if you rented a Redbox movie every weekend for the entire year, that would only cost you $78. But the point is, I really like saving money.

You can quickly find Redbox codes on Honey. If you are not using Honey, I highly recommend it. It is free.

Honey will run coupon codes for you. It's free. You can add it to Google Chrome as an extension and start flashing and alert you if there are coupon codes on any website. But I use it on Redbox. It will scan until it finds me the best code. (No, this is not sponsored by Honey or any of the other companies I'm talking about today but I am using some affiliate links you can read more about that here.)

4. Do two eat from the pantry challenges a year.

That means for one month, you're only going to buy a few basics of groceries and not your complete grocery haul for the month. You will end up saving between $200-500 depending on how much you spend on groceries.

The average US family spends $550 a month on groceries. But if you decide to go on a no-spend or a very limited grocery haul for the month, you're going to save $500. It's $1,000 a year.

5. Call your service providers, whether it be cell phone or internet, and see what kind of deals they can offer you.

We saved $600 one year just by asking. Seriously. Just by asking.

We switched from Verizon to Straight Talk a few years ago. We noticed very little difference. It turns out, where I live, Straight Talk runs on the Verizon tower, so it's basically the same coverage for less than half the price.

There are also places like Cricket and Republic Wireless where you can get very discounted cell phone plans.

6. Use eBates when shopping from home.

I love eBates. I don't find that I spend more. It's just useful when I'm buying things that I'm going to be using. Like, we bought a new dishwasher and we were able to get 7% cash back on that. Same thing with our new fridge.

We bought all of our appliances through eBates, sometimes vacations, those types of things. And we get a little cash back for our efforts. And when you sign up you can get a $10 gift card to Target or Walmart.

7. Accept hand-me-downs for things that you need. Or borrow.

I have told this story before. A few years ago, my vacuum cleaner died and I had carpet in my home at the time. I told my mom, "My vacuum cleaner died. I’ve got to go buy a new one." And she said, "No, you don't. I have this one. You can use it." It was very old, like, it took a bag. I think she bought it the year I was born. It was so loud; it made so much noise. But it worked. It cleaned my floor and it didn't cost me anything.

So be willing to temporarily accept things from people, if they're willing to give them to you.

Don't take stuff that you don't need just to be nice. But if you need a vacuum cleaner and your mom's got one that's like 29 years old, take it.

8. Check Craigslist before you hit up the store.

When Isaac needed a little booster to sit at the table, I did a real quick look on Craigslist and found the exact same one that I was about to buy off Amazon on Craigslist for $10.

How understanding the sales cycle can save you HUNDREDS on groceries

One of the best ways to start saving money at the grocery store and building a nice stockpile is by understanding your sales cycle.

It sounds super businessy and maybe a little scientific but it’s not.

One of the best ways to start saving money at the grocery store and building a nice stockpile is by understanding your sales cycle.

It sounds super businessy and maybe a little scientific but it’s not.

Here’s how it breaks down

The usual sales cycle at most grocery stores is 6 to 8 weeks. This means staples like frozen vegetables, pasta sauce, rice, cereal, toiletries, babyfood you name it goes on sale every 6 to 8 weeks.

This is when things are usually at their lowest price and you can get the most bang for your buck.

You can get these things at their lowest price fill your pantry and know that when they go on sale again you can stock up on them at the same low price.

There are seasonal sales cycles as well.

Things like barbecue sauce and charcoal are at their lowest price during the summer while cold medicine is at its lowest price in January.

The same thing applies to baking supplies around the holiday season. Getting to know how your sales cycle works at your grocery store takes very little effort but will yield huge savings.

If you're looking to save money without clipping coupons go here.

Why your stuff isn't selling: selling your clutter for cash

In case you didn’t know, I am a HUGE advocate for selling the stuff inside your home that you don’t need and putting that cash toward debt of other financial goals.

Americans have more stuff than we could possible need. I read a statistic recently that said that we buy 30% of the world's stuff. If you need some cash fast, selling your things online or on Facebook Marketplace or in a yard sale will help you make money in a few days.

But I've heard from a lot of you that your stuff just doesn't move like you want it to. So I'm going to help you troubleshoot that situation.

In case you didn’t know, I am a HUGE advocate for selling the stuff inside your home that you don’t need and putting that cash toward debt of other financial goals.

Americans have more stuff than we could possible need. I read a statistic recently that said that we buy 30% of the world's stuff. If you need some cash fast, selling your things online or on Facebook Marketplace or in a yard sale will help you make money in a few days.

But I've heard from a lot of you that your stuff just doesn't move like you want it to. So I'm going to help you troubleshoot that situation.

1. Make sure you're actually charging a fair price for your stuff.

Unless that item is highly collectible and really sought after, you're not going to make as much as you spent on that item. Sixty-five percent is a good place to start. So charge 65% of what you paid for that item.

2. Look at where you want to sell and see what similar items have sold for.

Look on eBay's complete listing (that means an item that sold) and see what that person got for it and what kind of condition it was in.

Look on Mercari or Poshmark or Facebook Marketplace and see what items are actually moving for.

Also, your area is going to depend on that. I might be able to sell something higher in my area than you are in yours.

I know that sometimes baby gear can fluctuate in price. Bicycles. That sort of thing. So you really need to keep that in mind.

3. Make sure you're taking good photographs of it.

If you are taking a photo of something in the back of your garage that's poorly lit and it's dirty, you're not going to sell it. Take the stuff outside. Wipe it down; clean it up. Take a picture of it in natural light.

If you have clothing items, lie them flat on the floor or hang them in front of a white background. Take a picture of them. Take it from different angles.

Photograph the defects. Photograph the unique things about that item.

Don't just lay them on the floor and take a picture where I can see your feet (that's gross; I'm not going to buy it). Put some effort into your photographs.

You don't have to have a fancy camera. You can just use your phone. But put forth the effort to make it look nice.

Now that doesn't mean to hide flaws. You need to always be honest and not be shady. But make your items look good. So make sure it's in good condition. You're not going to get top dollar for items that are damaged, scratched, broken and dirty.

4. Know where to sell it.

I have found — after years of selling — that not every place is equal.

For example, you used to be able to move clothing and handbags on eBay, but that's just not the case anymore. And eBay has gotten harder to use. Their app is kind of clunky, outdated and it's not user-friendly. I would use eBay for rare and hard-to-find items like toys, books and records, or technology. You can sell your broken cell phone or laptop on there.

I would use Poshmark and Mercari for selling clothing — Poshmark for higher-end items and Mercari for everyday (like Old Navy, Target, those sort of things). A tip on Poshmark: You can actually bundle items. If you see someone that's selling, like, three dresses from Nordstrom, you can ask them to bundle those items and maybe give you a little bit of a discount. I personally do that on mine — if you ever want to buy something from me, make me an offer.

Facebook Marketplace and Craigslist are the go-to (in my opinion) for selling larger items and furniture, that sort of thing. Because you don't want to pay to ship that across the country. You can move a nice piece of furniture on Craigslist or Facebook Marketplace.

You can also sell stuff via Amazon. If you have games, gaming system, DVDs, books, that sort of thing, you can actually ship them to Amazon's warehouse and they will take care of the shipping for you. And the payment is really easy because it is through Amazon.

5. Focus on your descriptions.

Put as much detail in there as possible — what the item is, what it is made out of, where it was made, what condition it's in, was your house pet-free and smoke-free.

You want clear and concise writing. You want lots of questions answered before they are ever asked — so lots of details in there.

You want it free from grammatical and spelling errors. You want to come across as professional, like you know what you're doing.

I got a comment recently that said that the person got annoyed because so many people were asking questions about what they were selling. One, that is part of the deal. That is part of it. You are selling something, so you are in the customer service business whether you like it or not. And, two, that may be a sign that your description is kind of crappy and you need to rewrite it.

6. You need eyeballs in front of your listings.

If you are selling on Craigslist, make sure to post a link to all your other listings. Make sure that you go in and edit it periodically so people can see it.

Same thing with Facebook Marketplace. Edit your posts frequently so it gets bumped back up.

7. Make sure to be smart.

If you are selling physical items on Facebook Marketplace or Craigslist, make sure that you meet in a public location, like a police department or library parking lot. Be safe about what you do. If it feels like a scam, it probably is one.

How to stop spending money: How to control the urge to shop

Do you have moments in your life when you feel spendy, like maybe you've come into a little bit of extra money or maybe you're trying to self-soothe. Yes, I've had moments where I have ended up spending a lot more money than other seasons of my life.

Let's talk about why you are feeling spendy and some ways to combat that.

Are you feeling spendy? Sometimes I feel spendy.

Do you have moments in your life when you feel spendy, like maybe you've come into a little bit of extra money or maybe you're trying to self-soothe. Yes, I've had moments where I have ended up spending a lot more money than other seasons of my life.

Let's talk about why you are feeling spendy and some ways to combat that.

Determine what is triggering it.

When you feel spendy, what is triggering it? What is setting off that desire?

Is it loneliness? Is it a sudden change you're compensating for? Is it grief? Is it excitement? Is it celebrating? If it's any of those things or any number of things, find some ways to redirect those.

For me, periods of grief, excitement and loneliness are when I spend money. I've been very open about that.

If you didn't know, this summer was really rough for our family. We went through an unexpected loss, and I got spendy. I ordered stuff off Amazon. I ordered so much stuff off Amazon. When the packages arrived, I didn't even remember what I had ordered. That's a trigger for me.

Let me tell you why. Because when I'm sad, I don't sleep. And when I don't sleep, I stay up looking on my phone. And when I'm looking on my phone, I get bored and I order stuff off Amazon.

Come up with a better solution

Once you figure out why you're feeling this way, come up with some better solutions.

Maybe it's avoiding the store entirely — like not going into Target, not going to Old Navy, not going wherever it is you spend your money. Maybe it's avoiding driving past the nail salon or the coffee shop. Or maybe it's not texting your certain friend who you maybe meet up for lunch.

Redirect that energy

Another thing is to redirect that energy into something more useful, like going for a walk or painting. I took up painting over the summer. I would put on music and cry and paint. And that took up my time at night when I wasn't sleeping.

Celebration — find a new way to celebrate. Maybe you have friends over for a barbecue or a potluck. Or just to watch a show with you — like, you make chili and you watch a show, whatever show it is that you watch together.

My final tip is to actually spend money, but spend it wisely. It may seem counterintuitive, but it's to actually spend the money. Cash only. Go into the store with just $20 and buy something that you wanted, something that you've been looking at. Maybe that will help get it out of your system.

Remember — I've said this before — your budget is there to serve you. If you have personal money and you want to spend it, by all means, spend it. That's just my theory.

I didn’t shop for a year and this is what happened

What happens when you commit to not buying clothes for a full year? A lot. Here are five things I discovered when I quit shopping.

Today I wanted to talk about my No Shopping for a Year challenge — how it went and some lessons that I learned from it.

In 2018, I committed to not buying clothes. Now I did give myself a few allowances. I allowed myself to buy two pairs of shorts, undergarments and a bathing suit.

I also decided I'm selling a bunch of stuff off Poshmark. I can use those profits to maybe buy some things that I need, but I ended up buying five things the entire year.

I would say it was a success. And I wanted to recap, share with you some lessons I learned, and explain why.

I realized that when I was out buying groceries, going on a Target run, or if I was at Sam's, I would end up stopping and looking at things — just because they were there. It wasn't necessarily things that I needed or even wanted, but it was on sale. Which is such a stupid reason to buy something — because it's on sale and you might need it later.

I never went into debt shopping. We didn't go back into debt. I wasn't swiping a credit card. I was just buying things I didn't need.

So I decided I'm going to do this little experiment: I'm going to shop my closet. I'm going to be really intentional about my purchases. And I'm going to see what happens.

I can't really think of any cons to doing this. There were no situations where I ended up missing out on a great fashion opportunity. If I didn't buy it, it just wasn't what I needed to do.

But I did want to share with you a few pros:

1. I realized what my spending triggers were: boredom and sadness.

I will shop because I'm bored. I will get on Amazon. I will get on the Target website. I will go to Target. Because I'm bored. Which is stupid.

My second spending trigger — sadness — took a little bit more to work through. Over the summer, I had a miscarriage. I talked about it a lot; I'm been very open about it. It has taken me a very long time to work through it, and that's okay; we all move at our own pace. But there are days when something would set me up and I'd be sad. And, then, I would find myself, during my kids' nap time, looking at Amazon on my phone for things I don't need. So I really had to check in with myself and ask myself: Why are you feeling this way? What brought this on? What can you do to make this a more positive outcome?

2. I saw what I actually wore.

I had a lot of stuff in my closet I didn't wear — I didn't like it, it wasn't the right color, I didn't like the way it looked on me, it didn't make me feel good, or the fabric wasn't great. I ended up — even though I was purging, not replenishing, and had fewer things in my closet — I felt like I had more options because I didn't wear things I didn't like.

I rediscovered my love for dresses and really long tops. And I just got creative in how to mix some outfits and make them look a little bit different. In that same vein, I kind of refined my personal style. I like a cute dress. I like a flat to go with it. And that's it. I kind of like more classic looks. I'm not super big into trends. I want things that are easy to wear, but I also want to look nice. I don't wear a dress every single day, but I do most days. And I will tell you that, even though I put zero effort into what I wear, people always say, "You look so nice" — just because you're wearing a dress. (Everyone just wears running shorts and oversized T-shirts now. I don't get it.)

3. I saved time.

Because when you kind of develop a uniform, you realize your sense of style, and you refine what's in your closet, you're not standing there forever saying, "I have nothing to wear." You just pull something out, put it on, and go about your day.

4. I have learned the danger and true cost of fast fashion.

We're obsessed with it, right? We see cute stuff in an online ad, in a magazine or on someone's Instagram feed — and we go out and buy it. We don't realize that, just because we saved a few dollars, there is a bigger cost to that.

There is, obviously, an environmental impact because of how quickly things are made, disposed of, dyed, and shipped. And all the packaging involved.

But there's also an even bigger and more horrifying human cost to that — in the way people are treated and the way that they are not paid a fair and livable wage. That's something that I've really had to think about: who made my clothes?

Now I'm not throwing out everything I ever bought at these fast fashion places because that would be wasteful in and of itself. But I've really had to evaluate where I want to spend my dollars and how I want to vote with my dollars.

5. This bled into other areas of my life.

I ended up not spending in other areas or just waiting to spend in other areas. At one point, I posted a picture on Instagram of the little bit of makeup that I had been using because I just hadn't bought any. (I did buy some after that.)

Not buying clothes definitely bled into other areas of my life. I ended up just not spending as much money this year across the board and, instead, using that money to either go into my savings, go towards goals, or going on really awesome trips with my kids.

3 reasons you shouldn’t buy a home: The hidden cost of home ownership

The truth is, buying a house might not be right for you. Today I am going to demystify the American dream — because home ownership is not for everyone. But first I want to say, if buying a home is your dream - go for it. But go for it with open eyes knowing all the facts.

The truth is, buying a house might not be right for you. Today I am going to demystify the American dream — because home ownership is not for everyone. But first I want to say, if buying a home is your dream - go for it. But go for it with open eyes knowing all the facts.

For years we have been told that the American dream is to graduate from college, start a great career, get married, and buy a home. These are all great things. (I have done every single one of them.)

But I don't necessarily think that they're all key to your happiness. They don't certainly define who you are as a person, right? You're defined by so much more than that. And if not careful, some of those things, while they seem like a blessing, can very quickly turn into a burden. Especially home ownership.

We bought our home in 2014 and will own it outright in a few short years, but I don't necessarily think that buying a home is the right decision for everyone.

I think that there are seasons of your life when it is the right time, and there are times when it is not. When my husband and I were newlyweds, we bought a house. Not the right time. But being a little bit older, and parents to children, and steady in our careers, with a home base, it was the right time.

I wanted to give you a few things to consider before you decide to buy a house.

1. The first is to consider hidden costs.

It is really easy to get into the idea that renting is throwing money away. I don't think that is true. My husband and I rented for a very long time and it ended up being a wonderful experience for us.

We actually saved money while we were renting. When we moved down here, it became hard to find a quality place to live for the rent that we wanted to pay. So for us, it did make financial sense to buy. But for a lot of people, it just doesn't.

You can't necessarily compare a mortgage with rent because there are so many hidden fees.

For example, taxes, insurance and if you live in a subdivision, you're going to pay a homeowners' association.

2. Home repairs fall on you

We put a new roof on our house shortly after we moved in, and we replaced the majority of our plumbing and all of our appliances, including our air conditioner. But when we sat down and we did the math on that, we still came out cheaper than what our rent would have been. That's not the case for everyone.

You can expect to spend 1-2% of your home value every year on repairs. (source)

That can be thousands of dollars a year on repairs and upkeep. I don't recommend always DIY'ing those. There are a few things that we DIY'ed, like wall repair. Our plumber cut a hole in our wall and didn't replace it. We had patch it up ourselves. That's obviously something we can do. But when it came to electrical work, we hired that out. You don't want to DIY something and then it turned out to be more costly because you need it to be repaired. If it's something that's going to require a permit, don't DIY it. If it's something that is potentially dangerous, like electrical work, don't DIY it. If it's something that you know absolutely nothing about, don't DIY it.

One of the things that rent gives you that home ownership doesn't is a little bit more flexibility.

If your job suddenly changes, you will have to break your lease and possibly pay fine, but you can still leave. Whereas if our job situation suddenly changed, we would have to sell our home. The good thing is, where we live, that's not so much a problem. This is a very desirable area. People want to buy homes.

3. Ownership lacks flexibility

For years we were told that home ownership was a great investment. I think that, in the right circumstances, it can be. But not everyone is in the right circumstances.

If you're going to live somewhere ten years or longer, then yes, consider buying. If you can save up and afford a down payment, yes, consider buying. If you live in a highly desirable area where you know that you will be able to sell your home fairly quickly, then, yes, consider buying.

If you're considering buying a home because your realtor friend told you to, or all of your other friends are, or your mom thinks it's a great idea, you might want to do some market research in the area for yourself.

What about you? I’d love to know what you think.

Quick and easy ways to save money now

I feel like part of my job and my duty to you as the sisterhood of savings is to give you tips on how to save money. Doing some of these things is how we got out of debt, how we stayed out of debt, how we've been able to cash flow things like cars and roofs and trips to Disney World.

I feel like part of my job and my duty to you as the sisterhood of savings is to give you tips on how to save money. Doing some of these things is how we got out of debt, how we stayed out of debt, how we've been able to cash flow things like cars and roofs and trips to Disney World.

1. Start meal planning.

Not only is this going to save you literally thousands of dollars because you're not throwing away food -- the average family in the US throws away $1,500 of food every year. Not with a meal plan -- but you also save time. Think about it.

If you come home on a Monday night and you're exhausted, you're going to spend at least 30 minutes wandering around your kitchen looking for something to eat. If you have taken 15 minutes on a Sunday afternoon to meal plan for the week, you just got hours of your life back. If you are spending 30 minutes every day or at least every week looking for something to eat, and you take 10-15 minutes to meal plan, you have saved hours every year.

2. Pack leftovers for lunch.

I have talked about this. You'll save at least $2,000 a year. Easy. A travel mug and take your own coffee. You can make coffee at home -- good coffee -- for 25 cents a cup. I love to use these pyrex containers for lunches.

3. Never run a movie without a Redbox code.

Even if it's not a completely free movie, get a Redbox code. I realized that Redbox is only like $1.50. I get it. And even if you rented a Redbox movie every weekend for the entire year, that would only cost you $78. But the point is, I really like saving money.

You can quickly find Redbox codes on Honey. If you are not using Honey, I highly recommend it. It is free.

Honey will run coupon codes for you. It's free. You can add it to Google Chrome as an extension and start flashing and alert you if there are coupon codes on any website. But I use it on Redbox. It will scan until it finds me the best code. (No, this is not sponsored by Honey or any of the other companies I'm talking about today but I am using some affiliate links you can read more about that here.)

4. Do two eat from the pantry challenges a year.

That means for one month, you're only going to buy a few basics of groceries and not your complete grocery haul for the month. You will end up saving between $200-500 depending on how much you spend on groceries.

The average US family spends $550 a month on groceries. But if you decide to go on a no-spend or a very limited grocery haul for the month, you're going to save $500. It's $1,000 a year.

5. Call your service providers, whether it be cell phone or internet, and see what kind of deals they can offer you.

We saved $600 one year just by asking. Seriously. Just by asking.

We switched from Verizon to Straight Talk a few years ago. We noticed very little difference. It turns out, where I live, Straight Talk runs on the Verizon tower, so it's basically the same coverage for less than half the price.

There are also places like Cricket and Republic Wireless where you can get very discounted cell phone plans.

6. Use eBates when shopping from home.

I love eBates. I don't find that I spend more. It's just useful when I'm buying things that I'm going to be using. Like, we bought a new dishwasher and we were able to get 7% cash back on that. Same thing with our new fridge.

We bought all of our appliances through eBates, sometimes vacations, those types of things. And we get a little cash back for our efforts. And when you sign up you can get a $10 gift card to Target or Walmart.

7. Accept hand-me-downs for things that you need. Or borrow.

I have told this story before. A few years ago, my vacuum cleaner died and I had carpet in my home at the time. I told my mom, "My vacuum cleaner died. I’ve got to go buy a new one." And she said, "No, you don't. I have this one. You can use it." It was very old, like, it took a bag. I think she bought it the year I was born. It was so loud; it made so much noise. But it worked. It cleaned my floor and it didn't cost me anything.

So be willing to temporarily accept things from people, if they're willing to give them to you.

Don't take stuff that you don't need just to be nice. But if you need a vacuum cleaner and your mom's got one that's like 29 years old, take it.

8. Check Craigslist before you hit up the store.

When Isaac needed a little booster to sit at the table, I did a real quick look on Craigslist and found the exact same one that I was about to buy off Amazon on Craigslist for $10.

How understanding the sales cycle can save you HUNDREDS on groceries

One of the best ways to start saving money at the grocery store and building a nice stockpile is by understanding your sales cycle.

It sounds super businessy and maybe a little scientific but it’s not.

One of the best ways to start saving money at the grocery store and building a nice stockpile is by understanding your sales cycle.

It sounds super businessy and maybe a little scientific but it’s not.

Here’s how it breaks down

The usual sales cycle at most grocery stores is 6 to 8 weeks. This means staples like frozen vegetables, pasta sauce, rice, cereal, toiletries, babyfood you name it goes on sale every 6 to 8 weeks.

This is when things are usually at their lowest price and you can get the most bang for your buck.

You can get these things at their lowest price fill your pantry and know that when they go on sale again you can stock up on them at the same low price.

There are seasonal sales cycles as well.

Things like barbecue sauce and charcoal are at their lowest price during the summer while cold medicine is at its lowest price in January.

The same thing applies to baking supplies around the holiday season. Getting to know how your sales cycle works at your grocery store takes very little effort but will yield huge savings.

If you're looking to save money without clipping coupons go here.

Cut the cable: Alternatives that save cash

It's been three years since Jason and I cut the cable and I don't think we have once regretted it. Not only has it helped save us a lot of money it also helps us control what our children watch and who markets what to them. (I really hope that sentence made sense!)

Today I wanted to delve into some alternatives to cable and satellite that might save you some cash.

It's been three years since Jason and I cut the cable and I don't think we have once regretted it. Not only has it helped save us a lot of money it also helps us control what our children watch and who markets what to them. (I really hope that sentence made sense!)

Today I wanted to delve into some alternatives to cable and satellite that might save you some cash.

1. Antenna.

We got this RCA multidirectional antenna from Amazon for about $25. It sits on our TV stand and we can pick up all of our local channels as well as PBS and a few smaller weather channels.

My parents use an outdoor antenna with the same results.

Pro: Antennas are VERY inexpensive in the grand scheme at about $25.

Cons. Not all antennas work for every home. Obviously if you live in the mountains a small antenna that sits on your table ain't gonna cut it. So trial and error, people. Trial and error.

2. Set top box.

A streaming device like Roku or Amazon Fire stick are perfect for the numerous streaming programs now available.

Pros: A lot of "free" channels are available on boxes like Roku. Channels like PBS, PBS Kids and Crackle, which shows movies with limited commercials.

You can also stream YouTube on these devices as well.

Cons: Each box is different as to what services it will and won't let you use. For example you cannot stream Amazon Prime on Apple TV because it competes with iTunes rentals.

3. Streaming services

Amazon Prime. For just $99 a year you can get a TON of movies, TV shows and other great features through Amazon.

If you don't know what all is available through your prime membership you can read a post I wrote about it a few weeks ago.

Pro: Lots of bonus features like two day shipping on Amazon orders, free books and unlimited music.

Cons: You pay $99 all up front. Content seems older and limited.

Netflix. We all know (and love Netflix). For just $7.99 a month you can watch as many TV shows and movies as you want. And the original content is good too.

Pros: A great value at just $7.99 a month and totally commercial free.

Cons: You do have to wait for a season to end it's current run to watch it.

Hulu. This is another one that runs just $7.99. There are tons of great TV shows you can watch just the day after they air. Plus you can cancel at any time.

Pros: Near-immediate access to new, hit shows.

Cons: Commercials. Yup, you are paying $7.99 a month to watch content with commercials. But you can upgrade to commercial free for just $4 more a month.

Sling. For $20 a month and NO contract you can stream live cable channels. You get access to TNT, ESPN, Disney, Food network. The list goes on. So it's all your favorite channels for a fraction of cable.

Pros: Again, way cheaper than cable and you can watch LIVE SPORTING EVENTS! This is perfect for Football season.

Cons: You do watch commercials. And depending on your internet connection it can buffer for long periods of time.

As you can see there are a LOT of alternatives to pricy cable and satellite plans.

What about you? Have you cut the cord?

This post contains affiliate links. You can read my disclosure policy here.

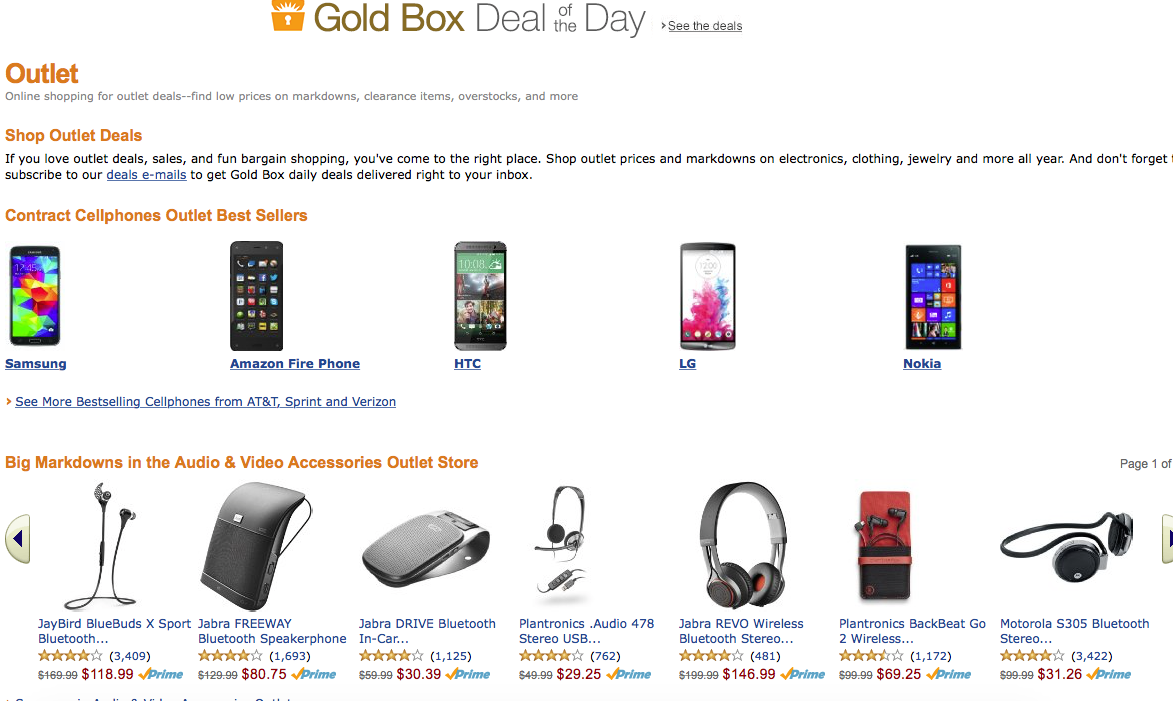

Amazon saving "secrets" to saving the most money

I love Amazon. I love any place where I can do the bulk of my shopping and not have to interact with people or put on pants.

But beyond that, I love the savings. I have learned a few "tricks" that have helped my save even more money on Amazon and I thought I would share them today.

I love Amazon. I love any place where I can do the bulk of my shopping and not have to interact with people or put on pants.

But beyond that, I love the savings. I have learned a few "tricks" that have helped my save even more money on Amazon and I thought I would share them today.

1. Looking for the lowest price on an item? Check out Camelcamelcamel.com. This third-party website allows you to track the lowest price. Simply put in the url of the product you are tracking, enter in a desired price and Camel will email you when that item nears your price point.

5. Choose filler items to get free shipping! If you're not an Amazon Prime member and you don't get 2-day shipping built in to your subscription, you will have to meet the $35 threshold to get free shipping. And often, you come up a few dollars short. Websites like FillerItem.com or FillerItemFinder.com allow you to search for items at a low price point to fit your filler needs.

6. Tell them a lower price! Okay. So this isn't really price matching, because Amazon doesn't price match. But sometimes if you use the "tell us about a lower price" tab near the bottom of the page your searching, they will lower the price.

Simply tell them where you saw a lower price, on line one in a store, and wait a few days. Come back and see if that price has been lowered.

7. Use a different browser. This has never worked for me. Ever. But I have heard from a few people who say it does work. If you search for an item in a second browser you're not currently using you will find a lower price.

Sign into your account as you normally would in one browser, say Safari. Then open Firefox, clear your search history and cookies and search for the same item while NOT logged into your Amazon account. Sometimes that price may be lower.

AGAIN, this has never worked for me.

Remember: You can sign up for Amazon Mom and save 20% on diapers! With Amazon Mom you automatically save 20% on diapers and free 2-day shipping. It's free to sign up and all parents, and caregivers (grand parents!!!!) are eligible. Sign up here for Amazon Mom (it’s FREE!)

Linking up at Thrifty Thursday, Frugal Friday, SITS Sharefest, Small Victories Sunday, The Thrifty Couple

What about you? How do you save money on Amazon?