How to STOP living paycheck to paycheck

The day I woke up and decided to stop living paycheck to paycheck. I remember the day clearly. We had more month than money, our checking account was in the red and we had about $136 in our savings account. That's a bad day.

One day I woke up and decided to stop living paycheck to paycheck. I remember the day clearly. We had more month than money, our checking account was in the red and we had about $136 in our savings account. That's a bad day.

It is days like that you feel you won't overcome, that you will always be in debt, that you will always feel the noose of credit cards and bad decisions and self-doubt.

But you won't. I am speaking directly to you, sister. YOU WON'T. You can break the cycle, you can get off the crazy train, you can own your life, get out of debt and stop living pay check to pay check.

Okay, so how does one break the crazy cycle? These are the things that worked for our family while we were working to become debt free.

1. We made a list of our debts.

Make a list of your debts and look at where your money is going. I know that you have heard this a million times, but it helps.

I admit, it might be hard to look at that number in black and white, but simply writing down your debts and looking at who you owe what will bring a little bit of sanity to the situation.

It was like looking at turn by turn directions on a really long trip. I knew if we could just get down one road and eliminate that debt we could then move to the next road.

2. We tracked our spending.

Look at where you're spending your money over a period of time. You can do this one of two ways, but either looking at your bank account or by carrying a notebook around with you and writing it down. I recommend the second one because you can really see your wasteful spending.

3. We got brutal about what we could cut.

You might think your budget is tight, but believe me there is usually something that can be cut.

Of course we did the usual like cut cable, dropped some subscription services, quit going to movies or even paying for rentals but we took it even further than that.

We quit using paper towels, we were less wasteful of food and utilities and we limited our driving to save on gas.

I started meal planning and learned to stretch leftovers and other ingredients.

4. We focused on the four walls.

The four walls are a concept Dave Ramsey talks about. They are food, electric/water shelter (rent/mortgage), transportation (because you HAVE TO GO TO WORK).

If you can get a handle on these things, get current on your rent and your car you will feel better. You won't feel as panicked, you will feel calm. Trust me. Trust me on this one. Do not, ever, under any circumstances, pay your Visa bill before you pay your rent or mortgage.

5. We cut our grocery bill.

This might not work for those of you with special dietary needs or allergies. But you can stretch rice and beans further than you think. Get your sales flyer, head over to Passionate Penny Pincher and learn to use some coupons.

No, coupons won't be the end all be all in your budget, but if you can learn to control your grocery budget you can learn to control other parts of your financial life.

6. We learned to say NO.

It was awkward. But saying no to social situations that cost us money saved us money. It isn't easy. It is awkward. But I found if you're honest with people they understand.

7. We learned to do without.

Since we are now out of debt I loosened the reins on this slightly (but I will be tightening them up as we work to pay off our house early) but we just did without things we didn't truly need.

We just recently bought a new dryer after years of using the same old dinosaur that was chugging along. It got our clothes mostly dry and I used a clothes line for a lot of things.

8. We said yes to hand me downs.

Our baby's crib, his clothes, my clothes, our bed, our dining table, even the terrible sounding but very efficient vacuum cleaner are all handed down. I understand that not everyone has hand me downs. But web sites like Freecycle and Craigslist have tons of free things from clothes to furniture.

9. We asked companies to lower our bills.

When our oldest was born I asked the hospital if they offered a discount for paying the bill all at once.

More recently Jason got the cellphone and internet company to lower our bills just by asking.

10. We sold things.

We listed things on Craigslist, eBay etc. It is amazing what people will buy. We sold a broken laptop for $150!

11. We found ways to earn extra income.

I started a small business working from home. This is actually something we started doing after we had gained control of our budget, but we did it as an effort to get the debt paying ball rolling.

12. We were honest about our expectations.

It will be hard. You won't like it. You will want to fall back into the old pattern of spending. But don't. Fight that urge. That's the only way to move forward and change your behavior.

What are you doing to eliminate debt in your life?

8 Tips to Saving Money on Produce

Is it expensive to eat healthy? I would argue no. In fact the weeks I run to the grocery store to pick up produce and milk are the weeks I spend less even though I buy the same in volume.

Today I am going to share some tips on saving cash on produce.

Is it expensive to eat healthy? I would argue no. In fact, the weeks I run to the grocery store to pick up produce and milk are the weeks I spend less even though I buy the same in volume.

Today I am going to share some tips on saving cash on produce.

(Side note: I am not claiming to be the healthiest of healthy eaters here. Don't get me wrong. But I am learning and I have made major lifestyle changes. Baby steps, y'all!)

1. Shop the front of your sales flyers.

The supermarket usually puts their sales produce toward the front of the sales flyer. This is a great way to plan your meals for the week.

2. Compare the cost of per bag vs. per pound.

I noticed the other day that the Red Delicious apples were $1.99 per pound, but the bagged Red Delicious apples were three pounds for $4.99. That came out to $1.66 per pound.

3. Shop at a cost plus market.

There are several "cost plus" markets in our area. These stores sell produce at their cost plus 10%. Often produce is much, much cheaper at these stores.

4. Don't assume frozen is cheaper.

This might actually require you pulling up the calculator app on your phone in the grocery store.

A 12-ounce bag of precut frozen bell peppers is $1.99 at my supermarket. But I can get a bag with six fresh bell peppers for $2.79.

Two bell peppers chopped usually equals the same as one of those precut frozen bags but will only cost me $.93.

5. But don't ignore frozen either.

Frozen produce is usually flash frozen at the peak of the season, meaning those frozen carrots you're going to serve as a side dish, or those peas you're putting in your fried rice were picked, processed and packed at their best.

6. Shake it off.

Don't spend money on water. Shake off your kale or fresh carrots before bagging them.

7. Take steps to make produce last longer.

I talked about this in a post on money-saving kitchen tips. There are a few things you can do to make produce last longer, like dividing your bananas so they don't touch and never store other produce with apples.

Strawberries don't like to touch or be wet. Store strawberries dry in a paper bag or in a large container with a lid, but not in the container from the store.

8. Use it don't lose it.

Food waste costs Americans $165 Billion annually (source). That's a lot of food getting tossed.

It's tempting to want to dole out produce to make it last longer, but what good does that do you if your strawberries are molding in the fridge. So go ahead and consume your produce so it doesn't get wasted in the fridge.

A diet rich in fruits and vegetables does not have to break your budget.

What about you? What tips do you have for saving money on produce?

Saving Money on Family Outings

Spring Break season is here and Summer is around the corner and that means it's time for some family activities.

When living on a budget family events and activities are NO different than anything else. They need to be planned and budgeted for. Today I wanted to share some tips for saving money on BIG family events.

Spring Break season is here and Summer is around the corner and that means it's time for some family activities.

When living on a budget family events and activities are NO different than anything else. They need to be planned and budgeted for. Today I wanted to share some tips for saving money on BIG family events.

This past weekend our family went to A Day Out With Thomas. It was probably THE most fun thing our family has ever done and we will do it again next year.

But we didn't do it without budgeting first.

1. Always budget more than you will need. Be realistic about what things actually cost. Gas prices are usually more than you think and you will need to fill up one more time than you planned. So I would say a safe bet is add 20% more to your event budget than you think you will need. This will provide you with a great buffer.

2. Always ask for a discount. When booking anything online I ALWAYS look for coupons codes by doing simple Google search. This time I was able to save us $6 on our tickets.

Even if there isn't a coupon code look for military, teacher, state employee etc. discounts. Or see if there is a bulk ticket rate.

3. Take your own food. Event food is crazy expensive. And let's be honest you usually feel really gross after eating it. We took a simple picnic of PB&J, bananas and graham crackers. We also packed our own drinks and extra sippy cups.

4. But spring for a treat. We did buy Ryals a snow cone. We planned to do this and the $3 was well spent.

5. Talk to your child about what you will and will not buy. We told Ryals from the get go "don't ask Mama and Daddy to buy you anything." And he didn't. He saw Thomas balloons and whistles and everything else and he didn't ask once.

I feel like if a 3-year-old can understand this an older child might be able to as well.

6. Splurge responsibly. We did buy our boys a souvenir. We had a set budget for this and we took them in the gift shop one at a time and let them pick it out. I showed Ryals the money, explained to him what he could and could not get and then let him give the cashier his money and count back the change.

Fun on a budget can be had, but like everything else it take intentionality.

What about you? What are your tips for doing a big event on a budget?

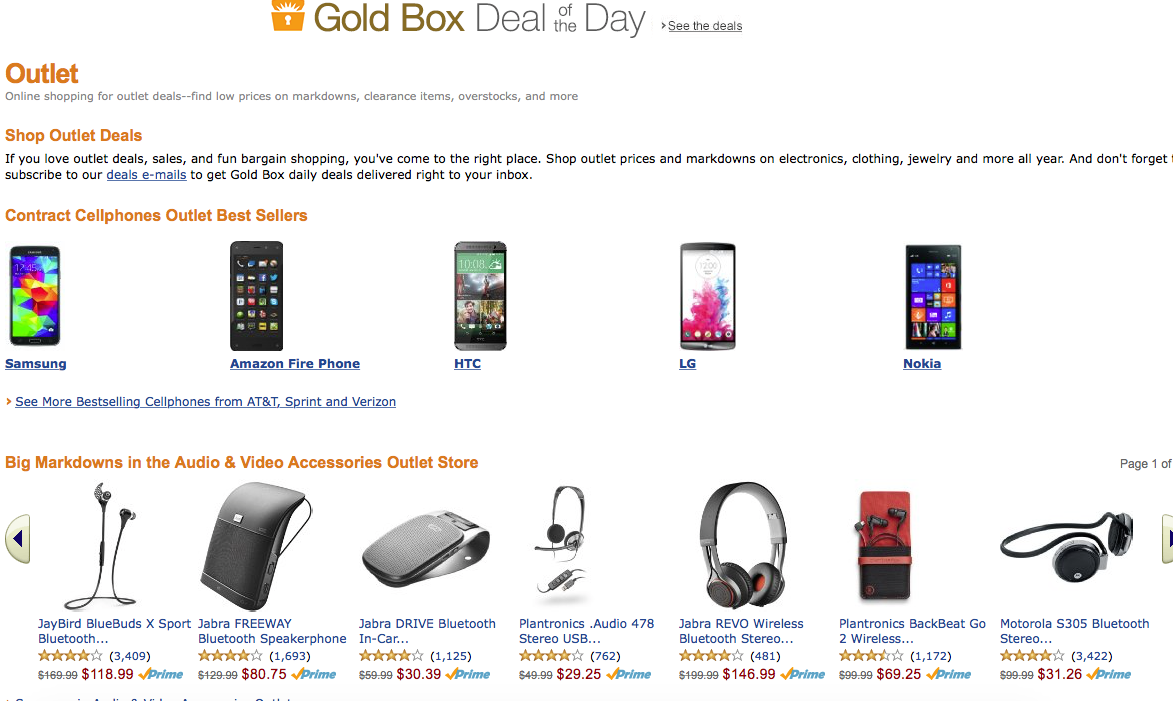

Amazon saving "secrets" to saving the most money

I love Amazon. I love any place where I can do the bulk of my shopping and not have to interact with people or put on pants.

But beyond that, I love the savings. I have learned a few "tricks" that have helped my save even more money on Amazon and I thought I would share them today.

I love Amazon. I love any place where I can do the bulk of my shopping and not have to interact with people or put on pants.

But beyond that, I love the savings. I have learned a few "tricks" that have helped my save even more money on Amazon and I thought I would share them today.

1. Looking for the lowest price on an item? Check out Camelcamelcamel.com. This third-party website allows you to track the lowest price. Simply put in the url of the product you are tracking, enter in a desired price and Camel will email you when that item nears your price point.

5. Choose filler items to get free shipping! If you're not an Amazon Prime member and you don't get 2-day shipping built in to your subscription, you will have to meet the $35 threshold to get free shipping. And often, you come up a few dollars short. Websites like FillerItem.com or FillerItemFinder.com allow you to search for items at a low price point to fit your filler needs.

6. Tell them a lower price! Okay. So this isn't really price matching, because Amazon doesn't price match. But sometimes if you use the "tell us about a lower price" tab near the bottom of the page your searching, they will lower the price.

Simply tell them where you saw a lower price, on line one in a store, and wait a few days. Come back and see if that price has been lowered.

7. Use a different browser. This has never worked for me. Ever. But I have heard from a few people who say it does work. If you search for an item in a second browser you're not currently using you will find a lower price.

Sign into your account as you normally would in one browser, say Safari. Then open Firefox, clear your search history and cookies and search for the same item while NOT logged into your Amazon account. Sometimes that price may be lower.

AGAIN, this has never worked for me.

Remember: You can sign up for Amazon Mom and save 20% on diapers! With Amazon Mom you automatically save 20% on diapers and free 2-day shipping. It's free to sign up and all parents, and caregivers (grand parents!!!!) are eligible. Sign up here for Amazon Mom (it’s FREE!)

Linking up at Thrifty Thursday, Frugal Friday, SITS Sharefest, Small Victories Sunday, The Thrifty Couple

What about you? How do you save money on Amazon?

How to STOP living paycheck to paycheck

One day I woke up and decided to stop living paycheck to paycheck. I remember the day clearly. We had more month than money, our checking account was in the red and we had about $136 in our savings account. That's a bad day.

One day I woke up and decided to stop living paycheck to paycheck. I remember the day clearly. We had more month than money, our checking account was in the red and we had about $136 in our savings account. That's a bad day.

It is days like that you feel you won't overcome, that you will always be in debt, that you will always feel the noose of credit cards and bad decisions and self-doubt.

But you won't. I am speaking directly to you, sister. YOU WON'T. You can break the cycle, you can get off the crazy train, you can own your life, get out of debt and stop living pay check to pay check.

Okay, so how does one break the crazy cycle? These are the things that worked for our family while we were working to become debt free.

1. We made a list of our debts.

Make a list of your debts and look at where your money is going. I know that you have heard this a million times, but it helps.

I admit, it might be hard to look at that number in black and white, but simply writing down your debts and looking at who you owe what will bring a little bit of sanity to the situation.

It was like looking at turn by turn directions on a really long trip. I knew if we could just get down one road and eliminate that debt we could then move to the next road.

2. We tracked our spending.

Look at where you're spending your money over a period of time. You can do this one of two ways, but either looking at your bank account or by carrying a notebook around with you and writing it down. I recommend the second one because you can really see your wasteful spending.

3. We got brutal about what we could cut.

You might think your budget is tight, but believe me there is usually something that can be cut.

Of course we did the usual like cut cable, dropped some subscription services, quit going to movies or even paying for rentals but we took it even further than that.

We quit using paper towels, we were less wasteful of food and utilities and we limited our driving to save on gas.

I started meal planning and learned to stretch leftovers and other ingredients.

4. We focused on the four walls.

The four walls are a concept Dave Ramsey talks about. They are food, electric/water shelter (rent/mortgage), transportation (because you HAVE TO GO TO WORK).

If you can get a handle on these things, get current on your rent and your car you will feel better. You won't feel as panicked, you will feel calm. Trust me. Trust me on this one. Do not, ever, under any circumstances, pay your Visa bill before you pay your rent or mortgage.

5. We cut our grocery bill.

This might not work for those of you with special dietary needs or allergies. But you can stretch rice and beans further than you think. Get your sales flyer, head over to Passionate Penny Pincher and learn to use some coupons.

No, coupons won't be the end all be all in your budget, but if you can learn to control your grocery budget you can learn to control other parts of your financial life.

6. We learned to say NO.

It was awkward. But saying no to social situations that cost us money saved us money. It isn't easy. It is awkward. But I found if you're honest with people they understand.

7. We learned to do without.

Since we are now out of debt I loosened the reins on this slightly (but I will be tightening them up as we work to pay off our house early) but we just did without things we didn't truly need.

We just recently bought a new dryer after years of using the same old dinosaur that was chugging along. It got our clothes mostly dry and I used a clothes line for a lot of things.

8. We said yes to hand me downs.

Our baby's crib, his clothes, my clothes, our bed, our dining table, even the terrible sounding but very efficient vacuum cleaner are all handed down. I understand that not everyone has hand me downs. But web sites like Freecycle and Craigslist have tons of free things from clothes to furniture.

9. We asked companies to lower our bills.

When our oldest was born I asked the hospital if they offered a discount for paying the bill all at once.

More recently Jason got the cellphone and internet company to lower our bills just by asking.

10. We sold things.

We listed things on Craigslist, eBay etc. It is amazing what people will buy. We sold a broken laptop for $150!

11. We found ways to earn extra income.

I started a small business working from home. This is actually something we started doing after we had gained control of our budget, but we did it as an effort to get the debt paying ball rolling.

12. We were honest about our expectations.

It will be hard. You won't like it. You will want to fall back into the old pattern of spending. But don't. Fight that urge. That's the only way to move forward and change your behavior.

What are you doing to eliminate debt in your life?

Starting the New Year with a NO SPENDUARY Challenge

HAPPY NEW YEAR! I hope everyone had a wonderful and stress free Christmas.

Now it is time to get back into the grind of life. Or at least gear up for it as you sit in your jammies on New Year's Day drinking a cup of coffee.

I am joining Danielle from Blissful and Domestic in issuing a No SPENDUARY Challenge. Some of you might remember that I did this last February with great success. That was the month we officially became debt free.

My family really wants to start the new year off on the right foot. We are now in a new house, and we have so many plans and some of them involved building back up our savings and working toward paying off our house in the next few years.

For the month of January the Senn Family has committed to not spending money outside of our basic obligations.

We will pay our bills, gas our cars and keep our babies in diapers. We will eat fresh produce and continue to meet our financial obligations. But we will NOT spend money on things outside of our basic needs.

No entertainment money, no going out to eat, no stopping by Goodwill just to see what cute sweaters are on the rack. None of that.

Instead we will put any extra money toward savings goals.

But we won't be doing the following:

- buying cups of coffee from Starbucks

- hitting up the drive through for breakfast

- buying books for our Kindle

- stopping by Zaxby's for lunch after church

- buying things simply because they are a good deal

I will be checking in each Monday to tell you how our progress is going. I will also be focusing on frugal meal plans, DIYs and entertainment.

I think it could be fun.

You can join us but don't be intimidated. This is not all or nothing. If you just don't feel up to the full commitment pick one area of your spending and focus on that. Say you just don't get coffee at the drive through all month and you carry a thermos instead or you don't hit up the Redbox and go to the library instead.

These little changes add up quick.

If you do decide to join in on the fun you can let me know just Tweet me, Facebook me or snap a photo for Instagram and use the hashtag #NOSpenduary!

We can do this!

What are some things you could give up for the month?